Recurring Payments: Definition and Implementation Best Practices

Stax

FEBRUARY 26, 2024

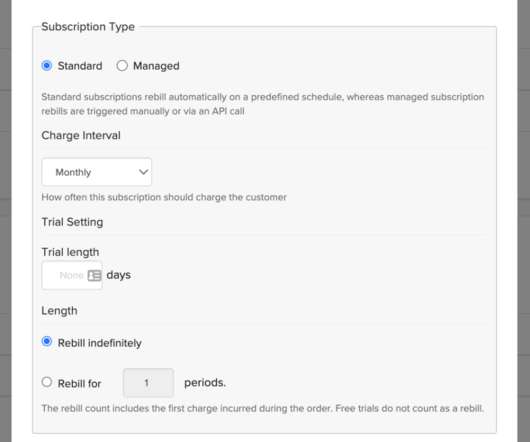

TL;DR Recurring payments refer to a financial arrangement where a customer authorizes a business to charge their account at regular intervals for products or services. There are a few types of recurring payments to be aware of, which one your business uses will depend on the business model and need for recurring or automatic payments.

Let's personalize your content