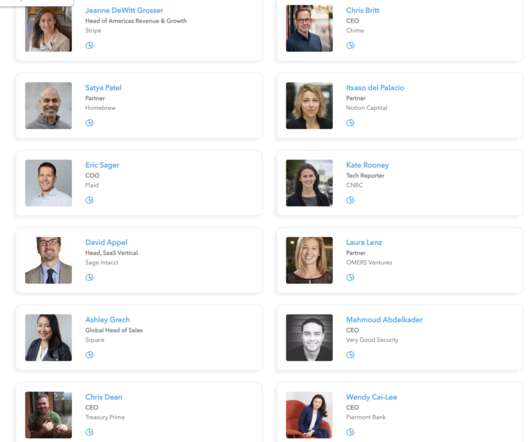

Thanks to Cyvatar, Pacific Western Bank, Upzelo, UserGems, and Younium for Sponsoring SaaStr Annual 2023!

SaaStr

NOVEMBER 17, 2022

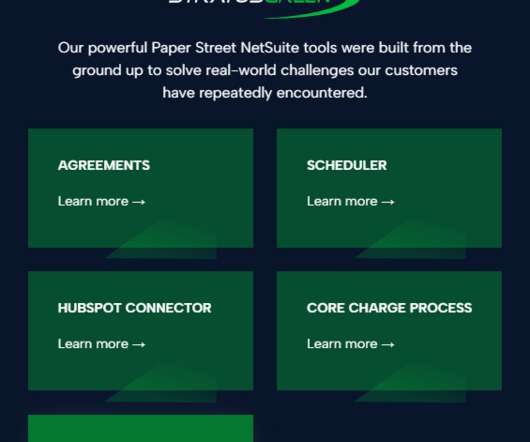

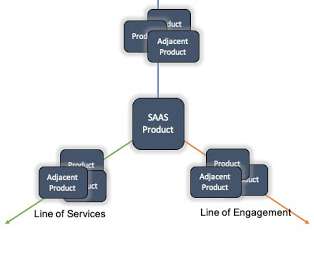

Cyvatar is a technology-enabled cyber security as a service (CSaaS) provider disrupting a $150 billion industry by introducing and delivering smarter, measurable managed security subscriptions to help you achieve compliance and security faster and more efficiently. We are not like other banks. appeared first on SaaStr.

Let's personalize your content