Clouded Judgement 4.26.24 - Azure Gives Positive Infra Software Preview

Clouded Judgement

APRIL 26, 2024

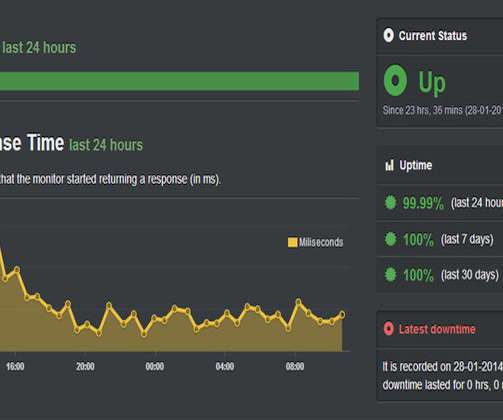

Subscribe now Azure Report - Cloud Infra Looks Good! For software, all eyes were on Azure - which grew 31% YoY (ahead of expectations closer to 29%). Azure doesn’t disclose exact Azure quarterly revenue (they disclose growth rate in absolute terms and in constant currency), but there are good estimations.

Let's personalize your content