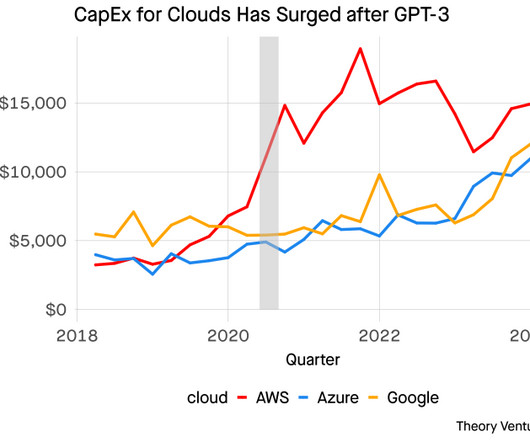

The Capex Conquest in the Cloud

Tom Tunguz

APRIL 30, 2024

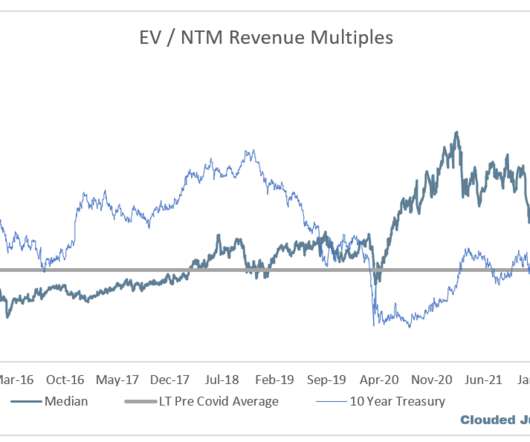

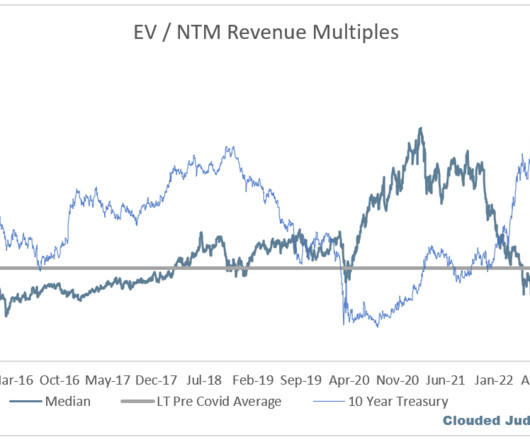

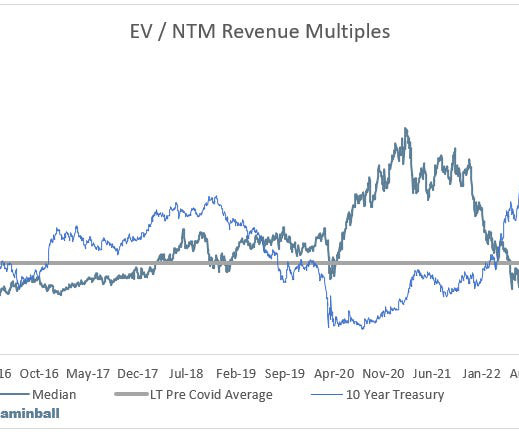

Cloud Capex in Q1 AWS $14 billion Azure $14 billion Google Cloud $12 billion These are not one-time investments, but part of a broader trend that started to occur after the introduction of GPT 3 in mid-2020 Amazon was the first to invest significantly. “Moving to AWS.

Let's personalize your content