The Vertical SaaS Gold Rush: Why Non-Tech B2B Is Growing 250%+ Faster

SaaStr

JULY 4, 2025

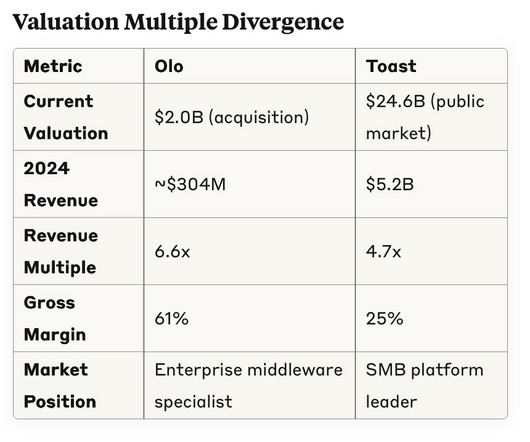

TL;DR: While most public SaaS companies are growing at 8-10%, the companies crushing it are those selling outside the tech bubble – restaurants, construction, logistics, and e-commerce. They’re growing 2-3x faster than traditional horizontal SaaS. Many are doing pretty, pretty, well. At Least Right Now.

Let's personalize your content