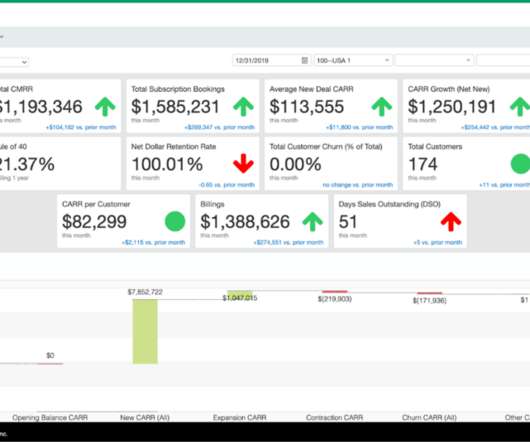

Innovative Strategies: How These SaaS Turned Payments into Profit Centers

USIO

APRIL 22, 2024

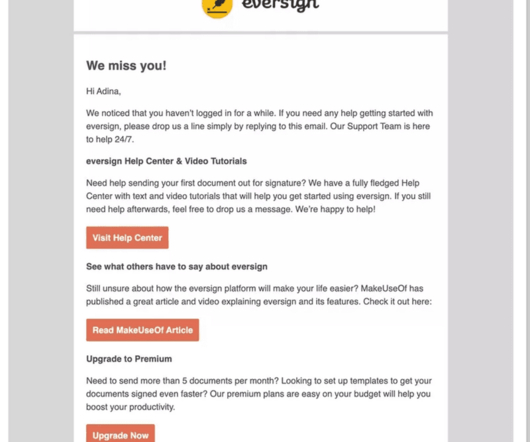

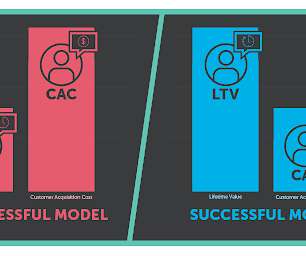

SaaS companies are continually seeking innovative strategies to not just maintain but amplify their growth trajectory and increase revenue. One pivotal yet often overlooked area is payments. We’ll delve into how SaaS companies are leveraging Usio Integrated Payment Solutions to propel their growth and increase revenue.

Let's personalize your content