How to Stop Micromanaging After $1m-$2m ARR. You Have To.

SaaStr

MAY 3, 2021

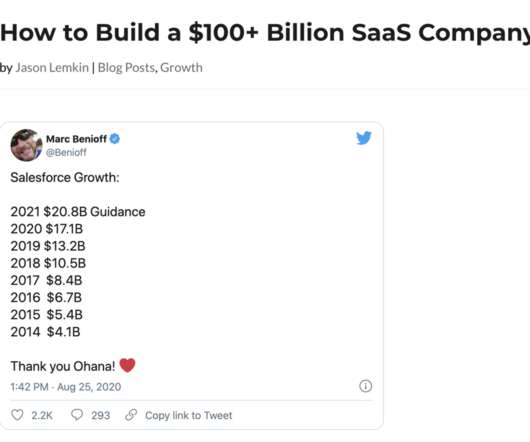

In the past, we’ve touched on several different ideas to help you scale, to do Even Better: Imagine capital doesn’t matter. the prospects). But even if you’ve hired the world’s best VP of Sales … you can’t opt out of sales entirely. And see where that takes you. Add a layer.

Let's personalize your content