Why Now is a Great Time to Raise Seed Funding. Even If It’s Awful for Series A-E Rounds.

SaaStr

JANUARY 23, 2023

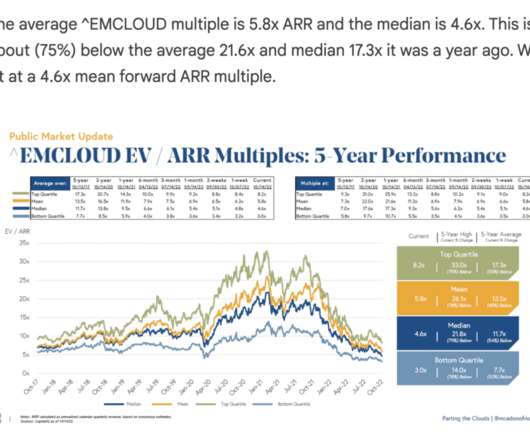

So now is simply a terrible time to be raising growth stage venture capital. With the BVP Cloud Index down 40%+ from a year ago , and many of the top Cloud leaders trading for as low as 5x ARR, it’s just hard to justify a later stage $300m-$400m valuation round these days, let alone a true unicorn round.

Let's personalize your content