The Early Days: How Deel Went From $1m to $100m ARR in Just 20 Months

SaaStr

JUNE 29, 2025

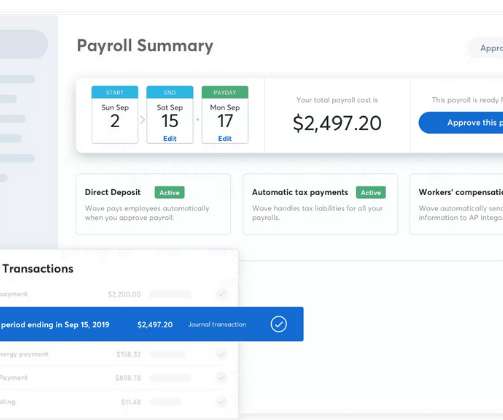

I dream about clients telling me, ‘Hey, I did not receive my payment today. ” In Y Combinator’s 10-week program, Deel burned through 20% of their time selling a payments platform that nobody wanted. ” The Discovery : Companies didn’t just need payments—they needed payments plus compliance.

Let's personalize your content