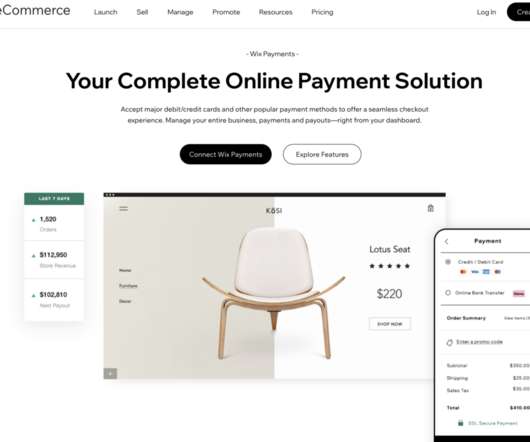

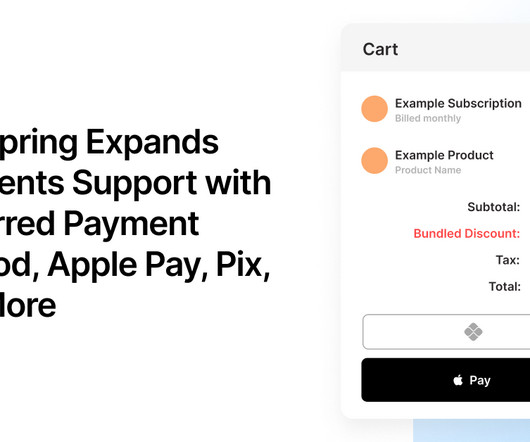

Use FastSpring’s Expanded Local Payment Methods to Grow Revenue in New Markets

FastSpring

MAY 20, 2025

Supporting country-specific debit networks, mobile wallets, and bank transfer schemes gives buyers seamless and trusted payment options. In turn, businesses gain access to the entire global market, boosting conversion and revenue along the way. Websites that localize pricing twice the conversion rate of those that do not.

Let's personalize your content