What it takes to be a category king

Chart Mogul

JUNE 29, 2018

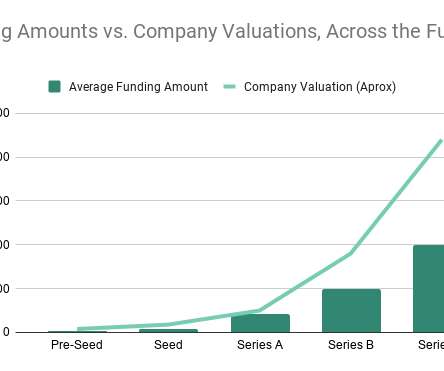

Category owners or “kings” are often lauded in the SaaS industry where they take a disproportionately large chunk of market revenue. This means that owning a category is in most cases a requirement for the level of growth and investment multiples that venture capital demands. ” from the market.

Let's personalize your content