5 Interesting Learnings from DigitalOcean at $500,000,000 in ARR

SaaStr

MARCH 9, 2022

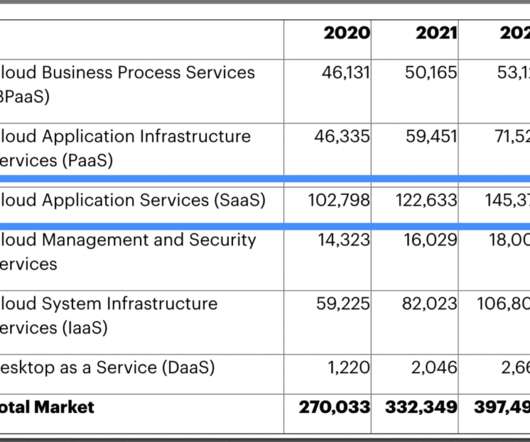

Focusing on smaller developers, in some ways it’s been a bit overshadowed by AWS, Azure, and Google Cloud. DigitalOcean is growing an impressive 37% at $500,000,000 in ARR, and staying very SMB with 600,000+ customers, but still driving deal sizes up a bit. They are only 15% of the customers, but 83% of the revenue.

Let's personalize your content