Micro Startup Acquisition: The Definitive Guide to Buying and Selling Small Startups

Neil Patel

NOVEMBER 9, 2020

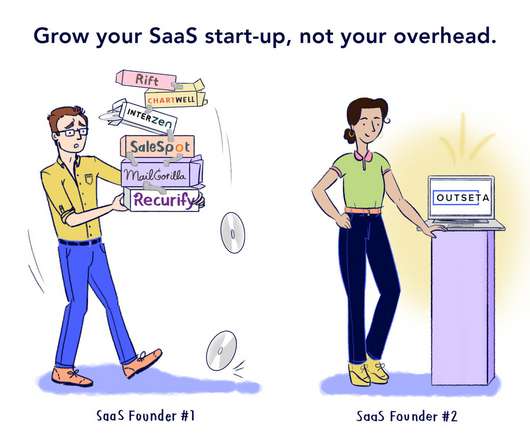

The solution? Micro startup acquisitions. But before we dive into that, we need to look into what micro startup acquisitions are and why you need to sit up and take notice. Micro Startup Acquisitions: What Are They, and Why Should I Care? Micro Startup Acquisition Trends. No one wants to be late to market.

Let's personalize your content