Use FastSpring’s Expanded Local Payment Methods to Grow Revenue in New Markets

FastSpring

MAY 20, 2025

Supporting country-specific debit networks, mobile wallets, and bank transfer schemes gives buyers seamless and trusted payment options. But dont take our word for it; the results from a Baymard study speak for themselves: Businesses that enable regionally preferred payment methods see 21% higher growth rates than those that dont.

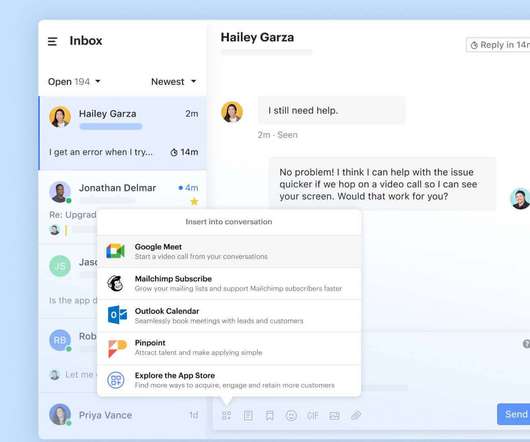

Let's personalize your content