5 Interesting Learnings from AppFolio at $660,000,000 in “ARR”

SaaStr

NOVEMBER 22, 2023

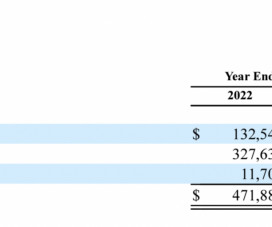

There are several big leaders in property management software, and AppFolio is one of them. At $660m in “ARR” (a lot of that isn’t software, as we’ll see below), it’s trading at a $7.2 AppFolio is what the markets want in a software+ company, at least in 2023. Let’s dig in.

Let's personalize your content