How to Properly Record Deferred Revenue in SaaS

The SaaS CFO

DECEMBER 12, 2018

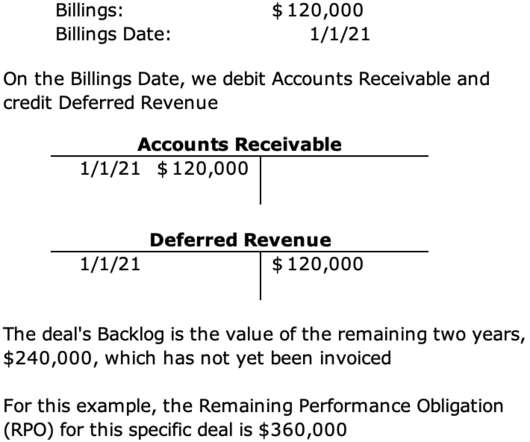

Software subscriptions are the life of every SaaS business. But most SaaS companies I have spoken with are incorrectly recording their most important revenue stream. That is subscription revenue and the corresponding deferred revenue balance. And I don’t blame you.

Let's personalize your content