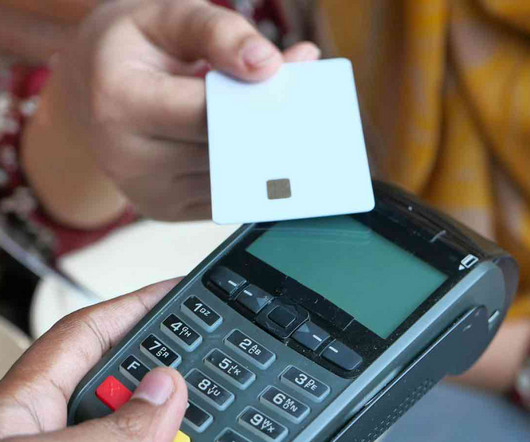

Mobile Credit Card Processing Explained: What Business Owners Need to Know

Stax

APRIL 18, 2024

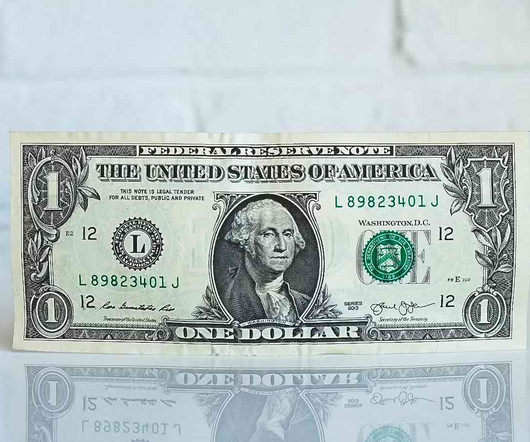

According to Forbes , “mobile payments are increasingly being used by U.S. Not only are there a number of ways your customers could be using their mobile devices to give payments, but you as a business owner could be leveraging mobile devices to accept them as well. shoppers as customers become more comfortable with the technology.”

Let's personalize your content