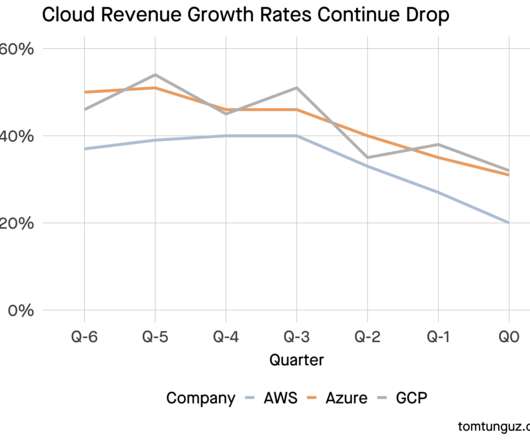

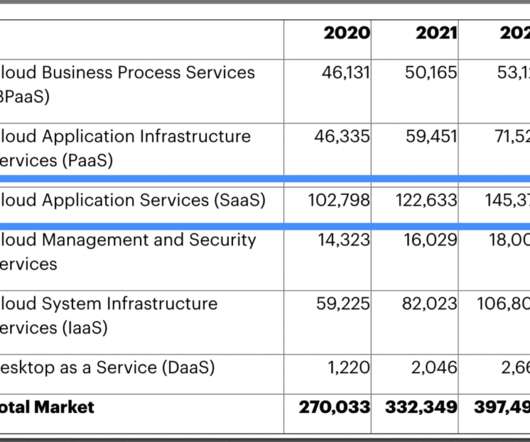

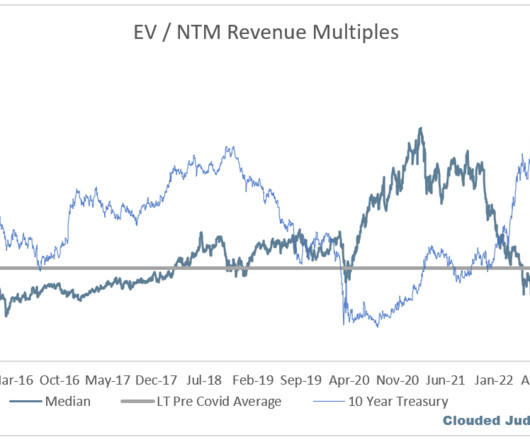

Predicting Cloud Growth Rates for 2023

Tom Tunguz

FEBRUARY 2, 2023

A year ago, AWS, GCP, & Azure averaged 44% annual growth. Amazon: We expect [customer] optimization efforts will continue to be a headwind to AWS growth in at least the next couple of quarters. So So far in the first month of the year, AWS year-over-year revenue growth is in the mid-teens.

Let's personalize your content