Our SaaS Start-up's Expenses, Equity Allocation, & Marketing Results After Three Years

Outseta

JANUARY 10, 2020

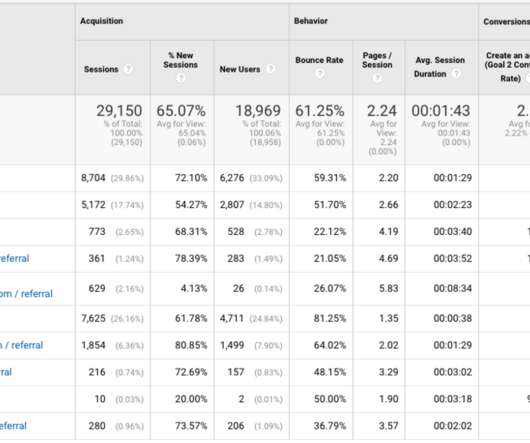

Needless to say, this is strong evidence that you don’t need millions and millions of dollars in venture capital to build a large scale SaaS application. While it’s premature for us to calculate a meaningful customer lifetime value, we think this cost per account sign-up bodes really well for the future.

Let's personalize your content