The Vertical SaaS Gold Rush: Why Non-Tech B2B Is Growing 250%+ Faster

SaaStr

JULY 4, 2025

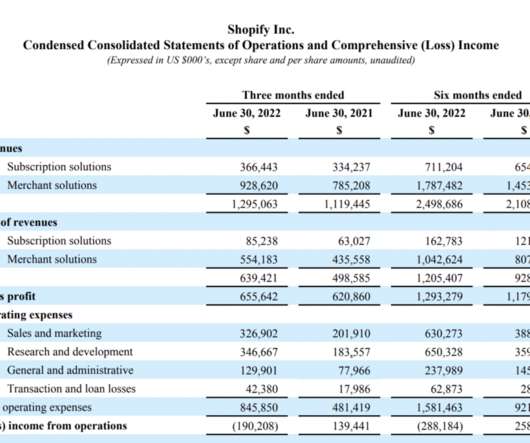

The Numbers Tell the Story: Monday.com Q1 2025 : 30% growth, $282M revenue Asana 2024 : Single-digit growth, struggling with churn Mostly Same Product Category, Mostly Different Customers Both companies build “work management” software. ” They’re digitizing their core business operations for the first time.

Let's personalize your content