It’s Time to Raise Your Debt Facility: Execution Tactics for Founders

Andreessen Horowitz

OCTOBER 4, 2023

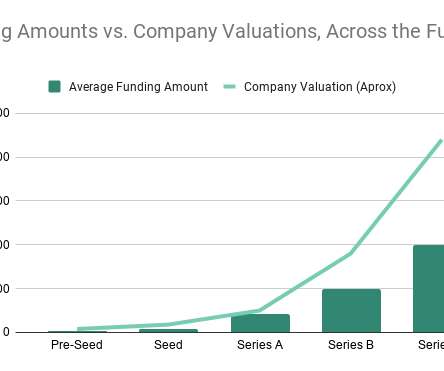

However, if a company has backing from a venture capital firm, we would recommend that they meet with their venture firms first to review the firm’s existing relationships and/or to get recommendations for lenders based on the company’s stage and preference. What type of asset is the company creating?

Let's personalize your content