Bootstrapping in SaaS? It Works. But Add ~4 Years to the IPO Timeline.

SaaStr

FEBRUARY 6, 2021

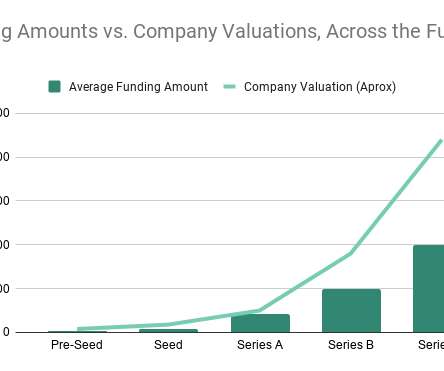

Companies like Atlassian and Qualtrics have cruised past nine-figures in ARR (and IPO’d in the case of Atlassian) without needing any venture capital. THEN, after $10m, bootstrapped SaaS companies seem to basically scale at the same rate as their venture-backed peers. Usually 4 years longer when you are bootstrapping.

Let's personalize your content