What Bootstrapped Companies Do Better than VC-Backed Ones with Paddle Chief Strategy Officer Patrick Campbell and Senior Product Manager Allissa Chan (Video)

SaaStr

DECEMBER 5, 2022

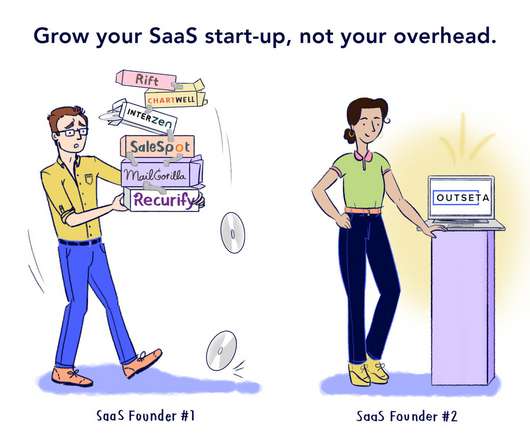

Startups often begin with a bootstrapping phase with little to no outside investment. Many, however, will eventually switch to the externally funded phase because bootstrapping isn’t for every business. Yet, funded startups can learn a lot from the bootstrapped ones to grow smoothly and generate revenue. Lever #5: Monetization.

Let's personalize your content