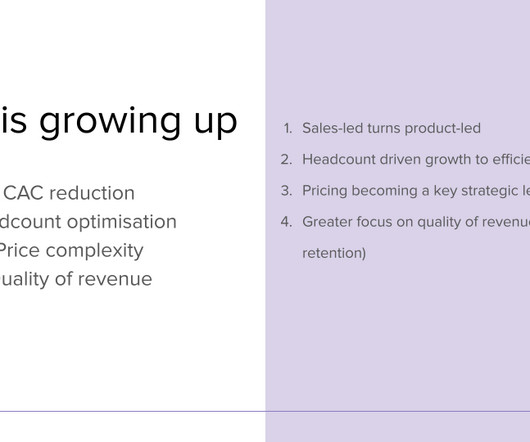

SaaS Is Growing Up: 4 Business Model Changes To Adopt with Notion Capital

SaaStr

SEPTEMBER 19, 2023

PST, Stephanie Opdam, Partner at Notion Capital, shares four business model changes that will allow SaaS companies to build resilience and staying power over time. This is where traditional SaaS methods like subscription pricing only, driving growth through headcount only, or a pure sales GTM strategy only live. Apple hasn’t done any.

Let's personalize your content