Is Deferred Revenue a Liability?

Baremetrics

AUGUST 25, 2021

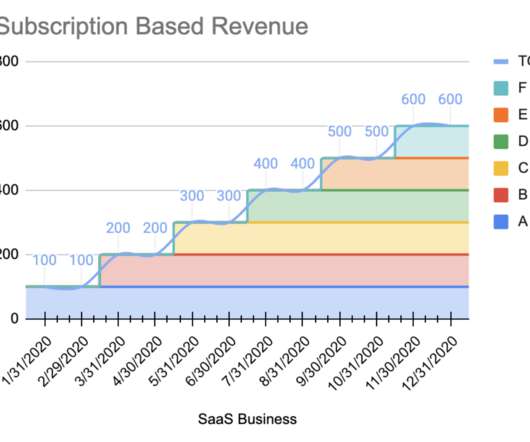

But, if you want to know why, you might need to read a bit more of this article — this article will dive into what are liabilities, what is deferred revenue, and how you need to document these values in your accounting. Sign up for the Baremetrics free trial , and start monitoring your subscription revenue accurately and easily.

Let's personalize your content