5 Predictions for 2021

Tom Tunguz

DECEMBER 16, 2020

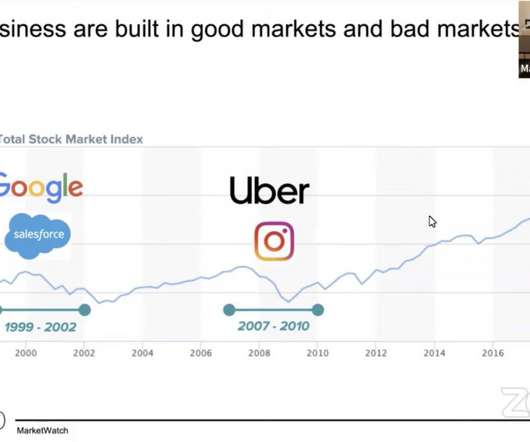

Here are my predictions for 2021. The IPO market hasn’t been this hot since at least 2012, but likely since the dot-com era. Companies with greater than 30% annual growth trade at 25x forward revenue, a figure that would have been met with unadulterated incredulity five years ago. The M&A market continues to surge.

Let's personalize your content