Most SaaS Metrics Really Only Work if You Have 75%+ Gross Margins and 100%+ NRR

SaaStr

DECEMBER 3, 2023

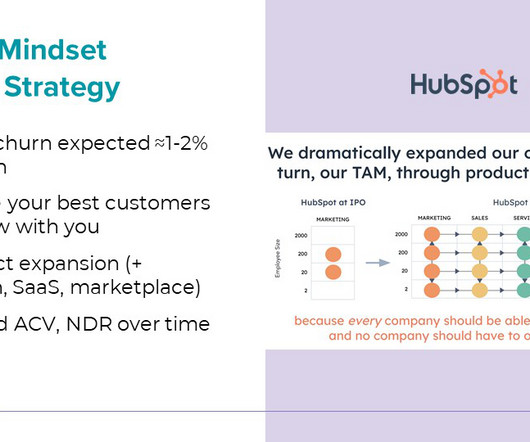

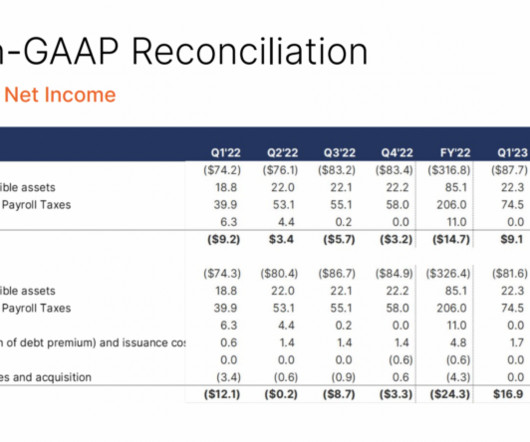

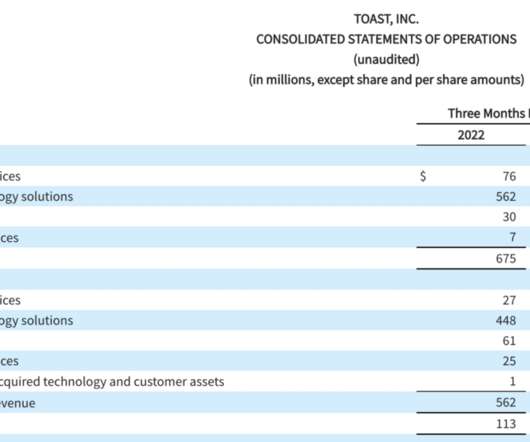

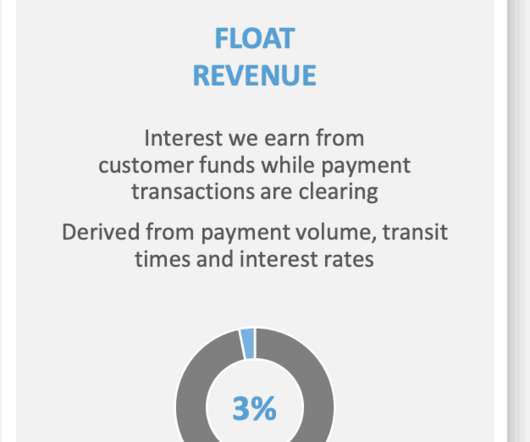

So over the past decade-and-a-half we’ve come up with a lot of yardsticks, metrics and rules for SaaS companies. But — they are broken if you aren’t really a traditional, 100%+ NRR SaaS company. In particular: Hybrid SaaS with payments and fintech usually has far, far lower gross margins than pure software.

Let's personalize your content