How Revenue-Based Financing and Venture Capital Funding Work Together

OPEXEngine

JANUARY 28, 2020

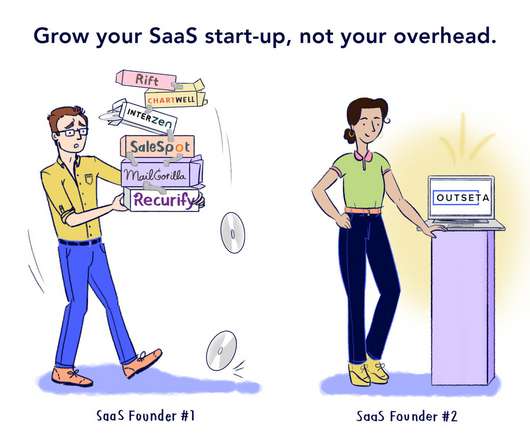

As alternative financing solutions attract more attention from entrepreneurs, some VC investors are noticing more startups are turning to these options for their growth and working capital needs, many times mixing and matching RBF with a term loan, line of credit with a forward commitment, or both. Funding options by stage of growth.

Let's personalize your content