The Benefits of Digital Disbursements

USIO

MAY 13, 2024

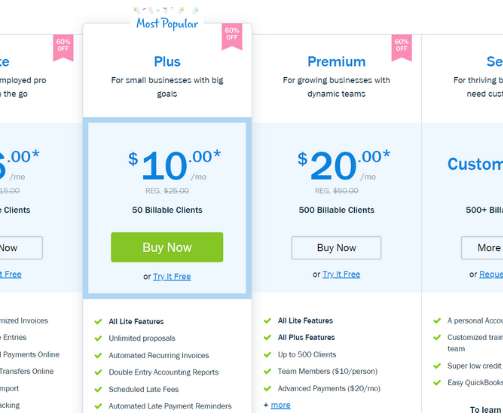

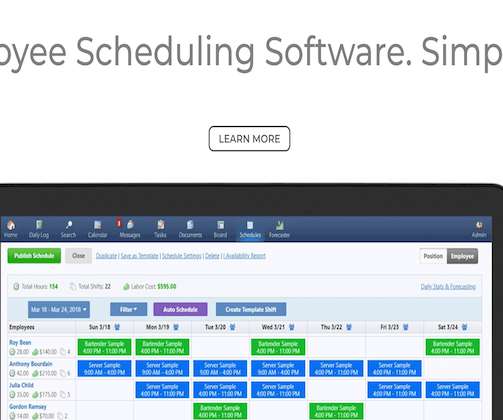

Paper checks usually cost around $4 to $20 and fluctuates due to certain companies and how they function. And this is including the accounting software into this expense of paper checks. Receiving the highest level of security and compliance with Nacha standards. Over time the world has seen a speedy decline with paper checks.

Let's personalize your content