3 Tips to Accelerate You to $100M ARR and Beyond with Payrix Director, Marketing Katie Wickham and Bob Butler, Payrix Chief Commercial Officer (Video)

SaaStr

NOVEMBER 21, 2022

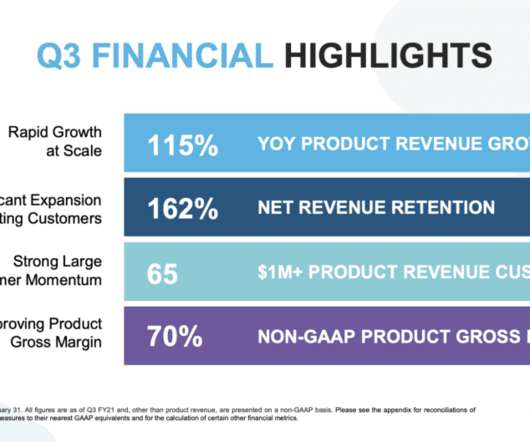

Wherever you are in your revenue journey, adopting certain growth strategies can help you keep growing fast. Joined by Katie Wickham, Payrix’s Director of Marketing, Butler shares essential tips on accelerating your business to $100 million ARR and beyond. . Brex then scaled its payments business quickly.

Let's personalize your content