What is a Payment Management System?

Stax

APRIL 11, 2024

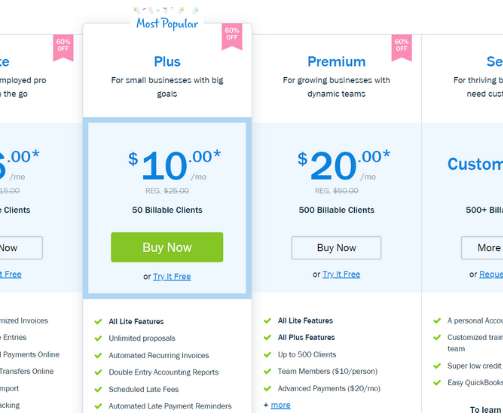

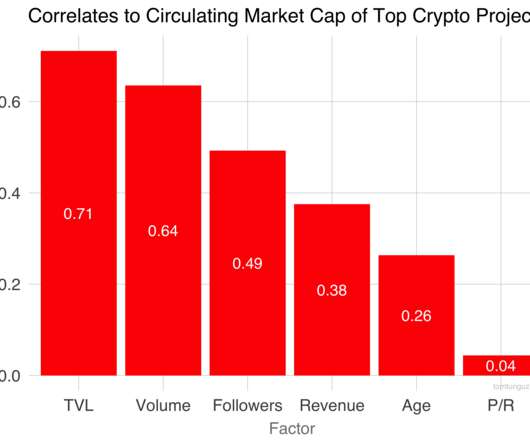

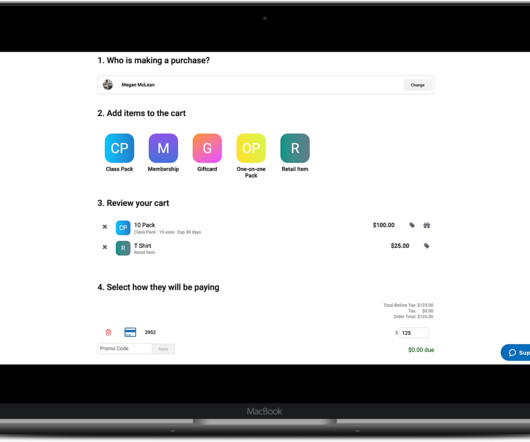

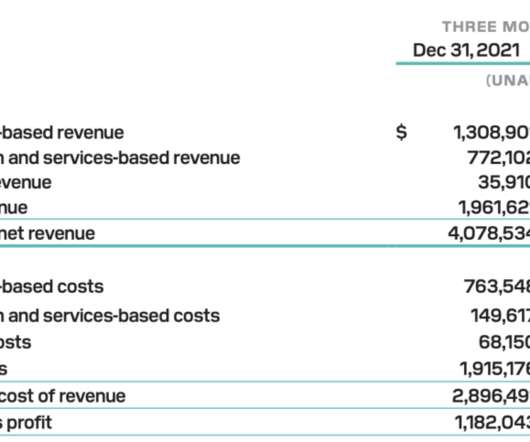

Adding to the already tough job of managing a small or medium business is the complex task of understanding how payment processing works, including managing the fees, equipment, accounts payable and more. Here’s where a Payment Management System (PMS) can swoop in as your financial hero to understand your business better.

Let's personalize your content