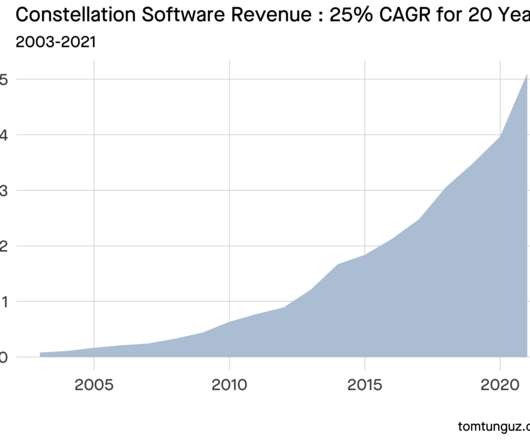

The Software Industry's Productivity Boom: Analyzing Revenue per Employee Trends

Tom Tunguz

NOVEMBER 12, 2023

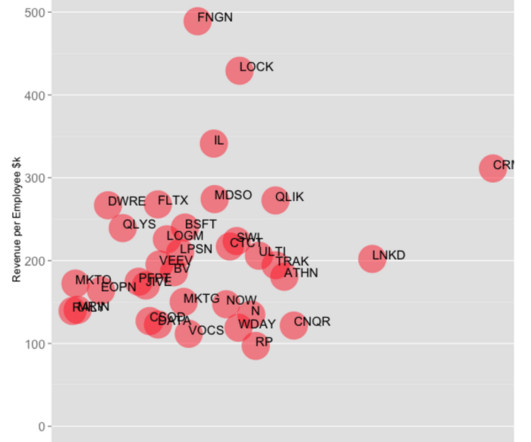

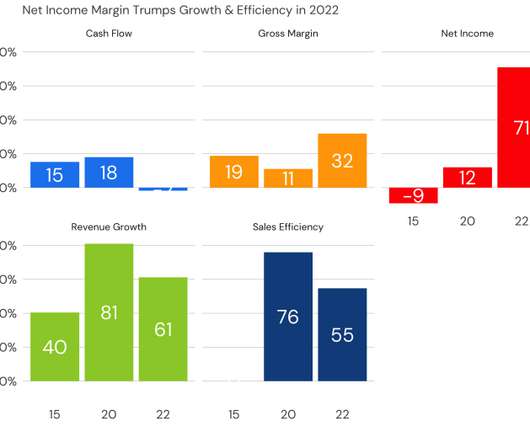

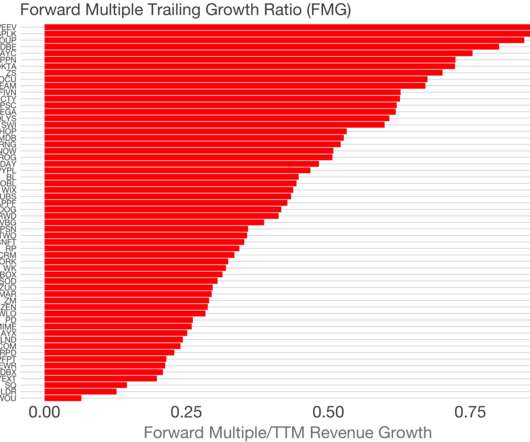

Recently, I was on the HR Heretics podcast and we talked about the increasing efficiency of software companies (in addition to other topics including the implications of AI for executives, how to diligence a candidate, & what board members expect of their people leaders). Revenue per employee spans approximately $200k-$900k.

Let's personalize your content