Micro Startup Acquisition: The Definitive Guide to Buying and Selling Small Startups

Neil Patel

NOVEMBER 9, 2020

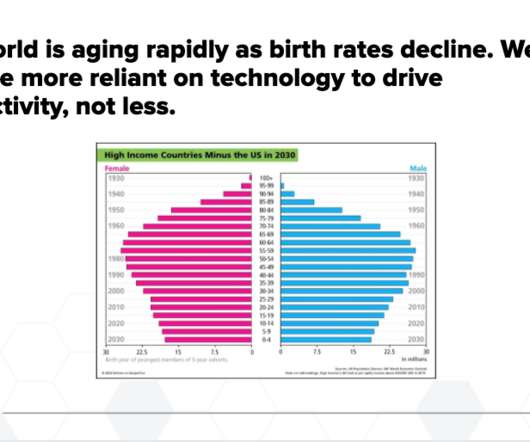

That’s an expensive mistake if you make the wrong investment. From Facebook to Microsoft, there is a massive trend to seek out tiny teams of five or less, buy them, and use the technology and talent to gain a competitive edge. Instead, larger tech companies like Twitter and Pinterest are making investments in small startups.

Let's personalize your content