Building Resilience Through Efficient Scaling In 2023 with ICONIQ Growth General Partner, Doug Pepper, and General Partner and Head of Analytics, Christine Edmonds (Video)

SaaStr

MARCH 7, 2023

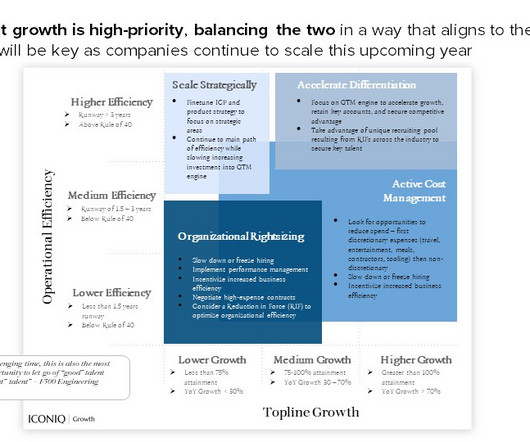

Pepper shares that ICONIQ, a venture capital firm with $10B under management, made fewer investments last year than ever before. Many of them said headcount management and spend were common levers they pulled, given the immediate and significant impact they have on spend. PST, to unveil the data behind effective scaling.

Let's personalize your content