How Adopting Mobile Payments Can Help Your Business Grow in 2024

Stax

NOVEMBER 6, 2023

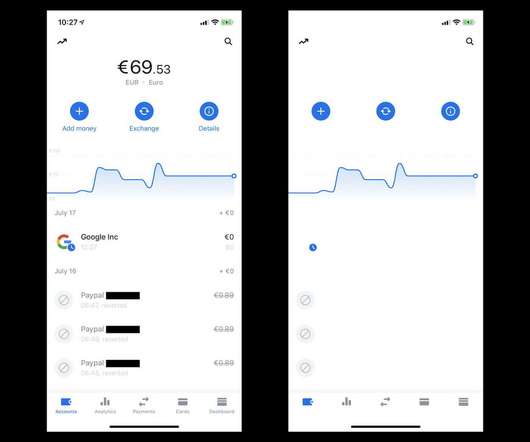

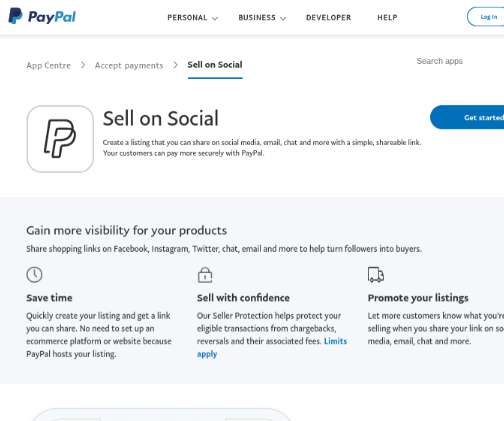

Fast forward to now where much has changed, and research anticipates contactless mobile payments to exceed one billion users globally by 2024. Customers can pay with their watch or phone just by tapping it on a card reader, and businesses can host an entire POS system on a mobile phone.

Let's personalize your content