Understanding Subscription Revenue

Baremetrics

AUGUST 22, 2021

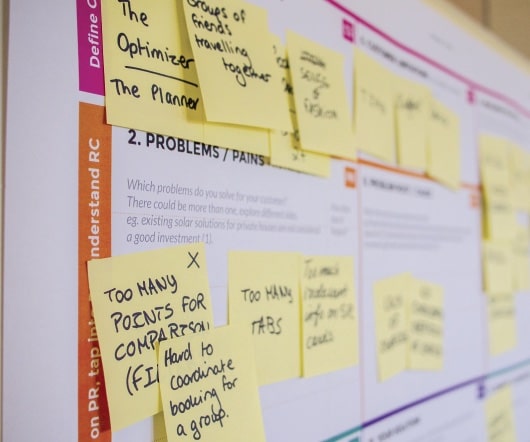

Subscription revenue can be defined most simply as a model which generates income from customers through recurring fees that are paid at regular intervals. These can be weekly, monthly, or annual payments. Before we get into the more complicated stuff, let’s consider the difference between earning revenue and collecting revenue.

Let's personalize your content