A Look Back at Q4 '23 Public Cloud Software Earnings

Clouded Judgement

APRIL 11, 2024

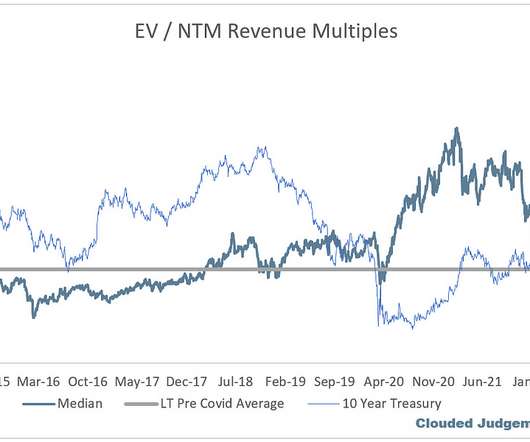

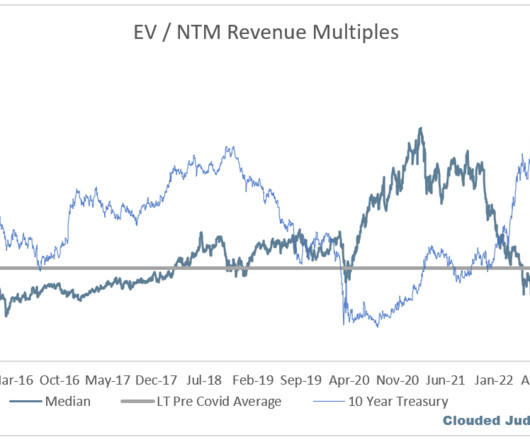

It looks at the YoY dollar change in quarterly revenue from the hyperscalers (just looking at Azure / AWS because the data goes back further) going back a few years. If we break this down and look at Azure and AWS independently (graphs below), you’ll see how the AWS “swings” were a lot more volatile.

Let's personalize your content