The Ultimate Guide to Ecommerce Payment Solutions

Stax

APRIL 3, 2025

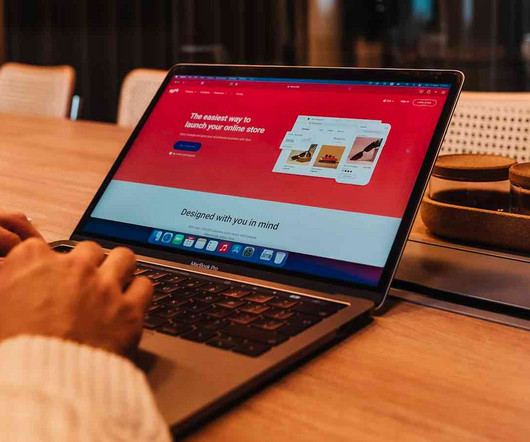

According to the Worldwide Retail Ecommerce Forecast 2024 by eMarketer, eCommerce will account for 21.0% Like most business owners, your instincts tell you to hop on the bandwagon and launch an online store for your business. This ultimate guide will teach you everything you need to know about eCommerce payment solutions.

Let's personalize your content