Managing Deferred Revenue for SaaS Companies: Best Practices for Tracking, Reporting, and Analysis

SaaS Metrics

JUNE 16, 2023

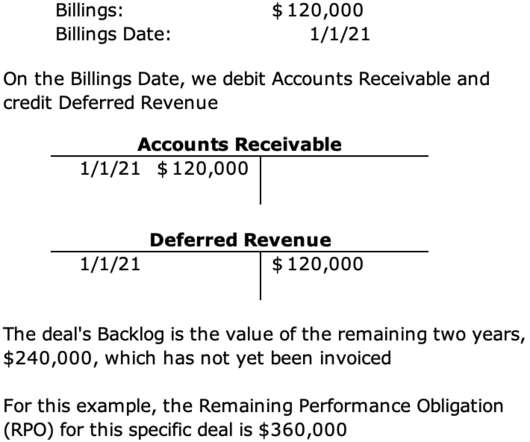

When a customer pays for a service upfront that won’t be delivered until later in the future, the company does receive the cash. But the revenue generated from the advance payment cannot be marked as earned — at least not until the service has been rendered. This unearned revenue is called deferred.

Let's personalize your content