PayPal Fees: How They Work and Alternative Solutions

FastSpring

JANUARY 26, 2021

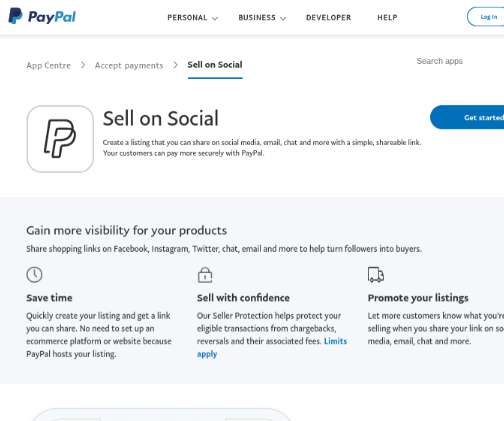

If you run a small business, nothing beats the convenience and simplicity of a service like PayPal. But this convenience is somewhat deprecated when you look at your PayPal account and see a significant problem: fees. How much does PayPal charge?” The Anatomy of the PayPal Fee Schedule. What Percentage Does PayPal Take?

Let's personalize your content