Everything You Need to Know About Secure Payment Processing Systems

Stax

MARCH 15, 2024

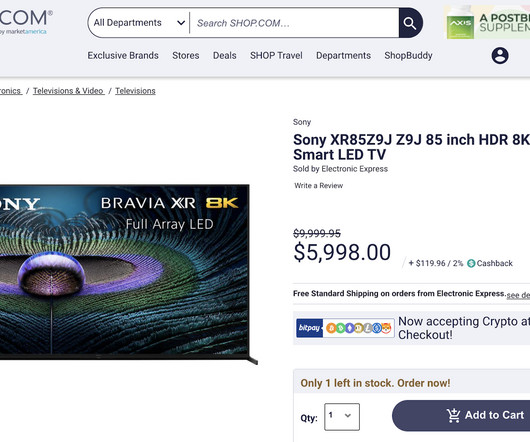

Data protection and security are crucial not just for safeguarding customer information, but for protecting business owners as well. Having and maintaining secure payment systems is integral for protecting yourself and your customers. Enter secure payment systems (SPS). What Are Secure Payment Systems?

Let's personalize your content