SaaS Is Spurring the Next Cycle of Software Superperformance

OPEXEngine

OCTOBER 5, 2021

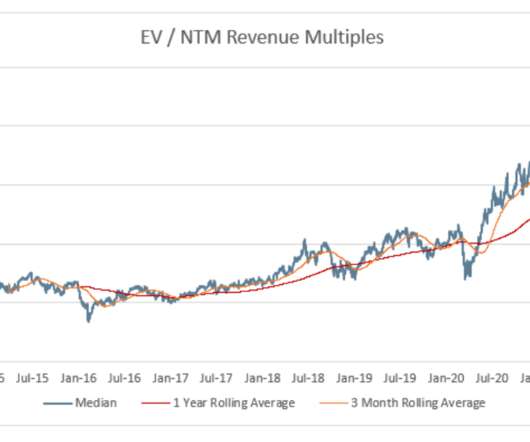

In more mature software companies, we see oversized returns for companies that are moving to software-as-a-service subscription models (see Figure 1). Software and other technology deals have been more likely to overperform and less likely to underperform than most investments in other sectors. Sticky after all.

Let's personalize your content