How to grow your field service platform’s revenue up to 3x with payments

Payrix

APRIL 10, 2025

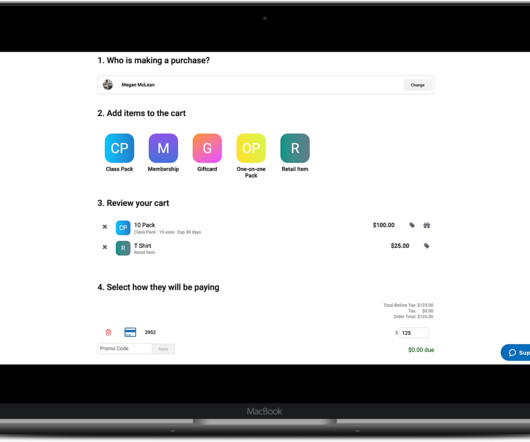

As a result, leading platform providers in the space are implementing strategic payment solutions to help generate more revenue from their existing customer base, create stronger relationships with users, and streamline the payment experience for everyone involved. This is common when outsourcing payments.

Let's personalize your content