SaaS Balance Sheet Examples

Baremetrics

SEPTEMBER 10, 2021

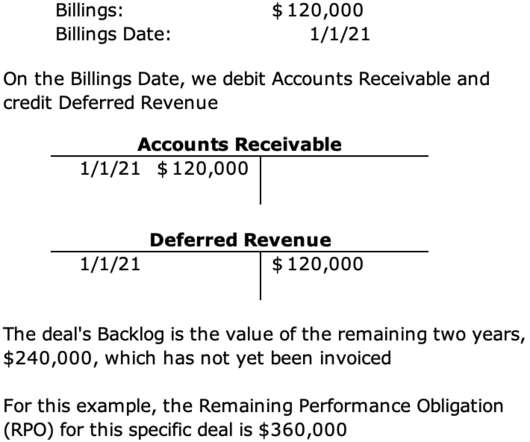

Assets are all the things of value possessed by the company, whether financed by liabilities or equity. In the case of a SaaS business, your most valuable assets are the contracts you have with your clients and the platform they use. How are balance sheets unique for SaaS? Many SaaS businesses have zero inventory.

Let's personalize your content