SaaS Financial Audits: 5 Tips for a SaaS Company's Financial Audit

ProfitWell

JULY 20, 2020

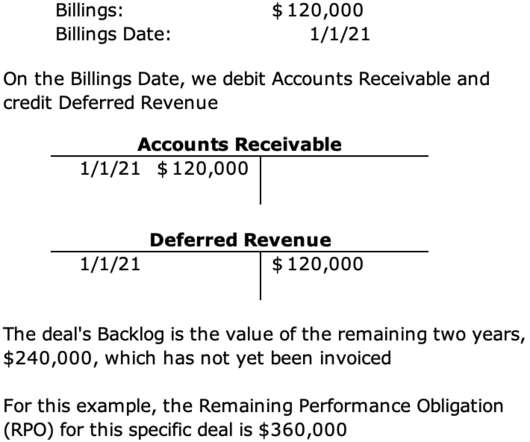

The following are some of the reasons why a SaaS financial audit is different: Recurring payments. SaaS companies sell their software on monthly subscription models, whereby the user has to pay a monthly fee to continue using the software. Long-term payment structures. Have an effective accounting system.

Let's personalize your content