SaaS Financial Benchmarks by Baremetrics

Baremetrics

JULY 7, 2021

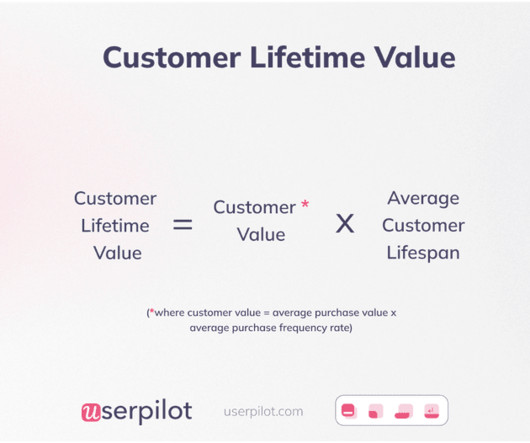

For SaaS companies, success depends highly on using key metrics to track financial growth and enhance visibility into all the key performance indicators. Another major interest is comparing one's growth and performance with other companies in similar SaaS niches. All the data your startup needs 1 What are SaaS financial Benchmarks?

Let's personalize your content