5 Interesting Learnings from BigCommerce at $180,000,000 in ARR

SaaStr

MARCH 25, 2021

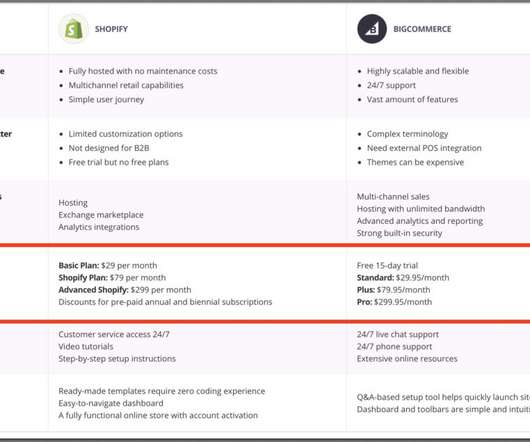

Shopify is #1 in so many market segments, but for “bigger” SMBs BigCommerce (and perhaps less-custom enterprise deployments) is arguably #2 to Shopify. It’s much smaller than Shopify, at $170m ARR vs $3B+ ARR, but it’s still plenty big for us to learn a lot from this big but not #1 player in the market.

Let's personalize your content