What is an Online Terminal and Why Do Merchants Need One?

Stax

MARCH 26, 2024

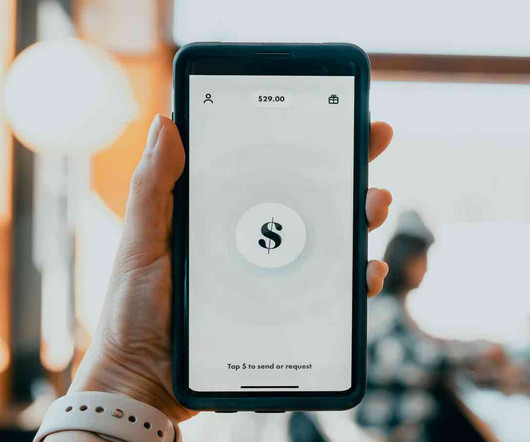

Online payment systems are the standard. Online terminals (sometimes referred to as virtual terminals) power various types of transactions, including eCommerce and payments made over the phone. They act as a bridge between traditional payment processing and online payment possibilities.

Let's personalize your content