Gartner: SaaS Spending Will Grow Another 40% in Next 2 Years Alone

SaaStr

APRIL 27, 2021

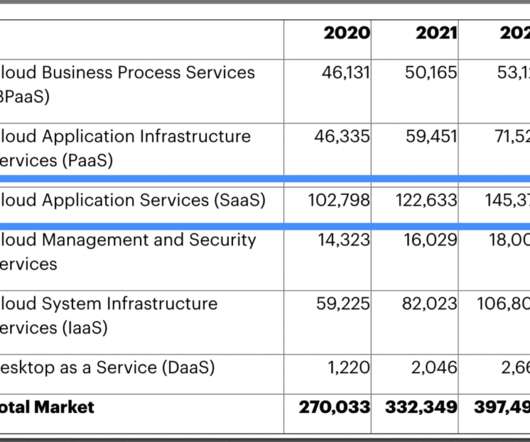

Cloud software spending grew a stunning 23% in 2021, from $270 billion to $330 billion. In my 148 public SaaS companies (including most of the categories of this list but not AWS, Azure, GCP) the aggregate revenue is $185B. — Gabriel Colominas (@GabrielCoBi) April 27, 2021. One thing we know — Fast.

Let's personalize your content