Empowering Your Business with Stax Bill: A Comprehensive Guide to Billing Platforms

Stax

JANUARY 29, 2024

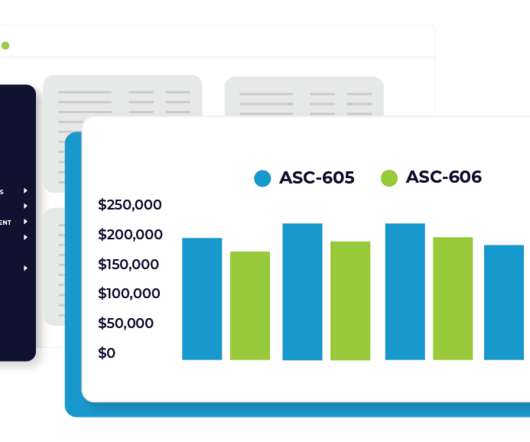

In this article, we’ll explore the significance of billing platforms in contemporary business, delve into the features that set Stax Bill apart, and guide you through the process of selecting the right billing solution for your unique needs. said Suneera Madhani, founder and CEO of Stax. “The

Let's personalize your content